The Sharpe Ratio

The Sharpe Ratio is used to set the return of an investment in relation with its risk.

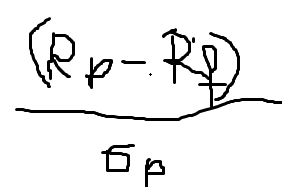

In oder to caluclate the sharpe ratio you first deduct the risk free market rate from the performance of the financial instrument. The risk free market rate could be for example the Euribor in case of an investment fund operating in the EU. The resulting amount (net return) you then devide by the standard deviation of your financial instrument.

- Rp = Return investment product

- Rf = Risk free rate

- Sigma p = Standard deviation investment product

A higher Sharpe Ratio is generally better then a lower one.

Portfolioflows

0