Discrete (arithmetic) mean return vs geometrical mean return vs log return

“Discrete” suggests one receives the interest amount at the end of a period.

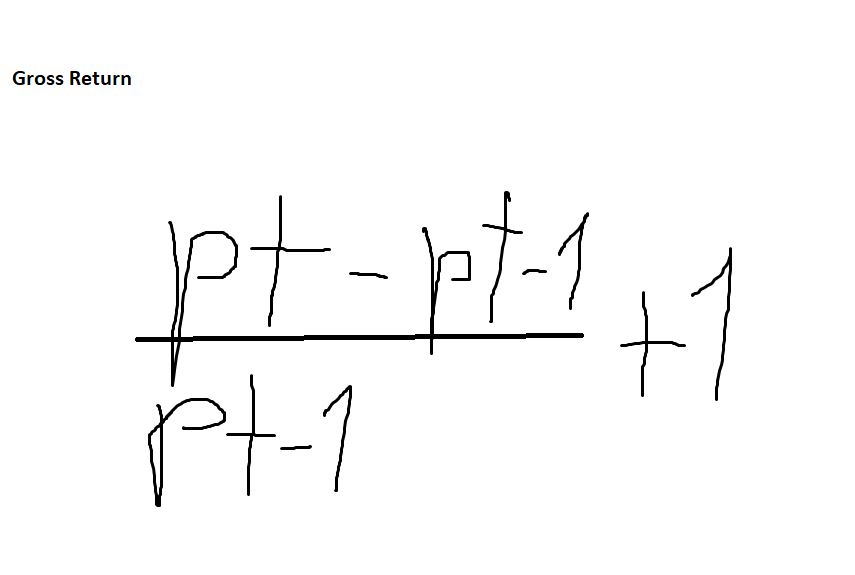

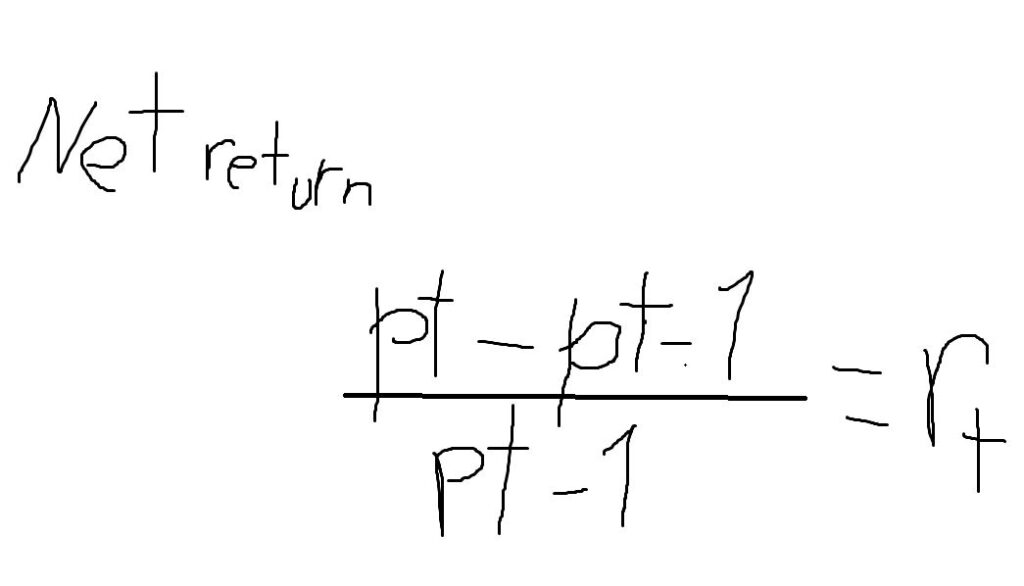

Discrete net and gross returns for one period

Gross return for one period (p = price)

Net return for one period

Discrete net return for several periods:

As you can see below, you need to combine discrete net returns by multiplication.

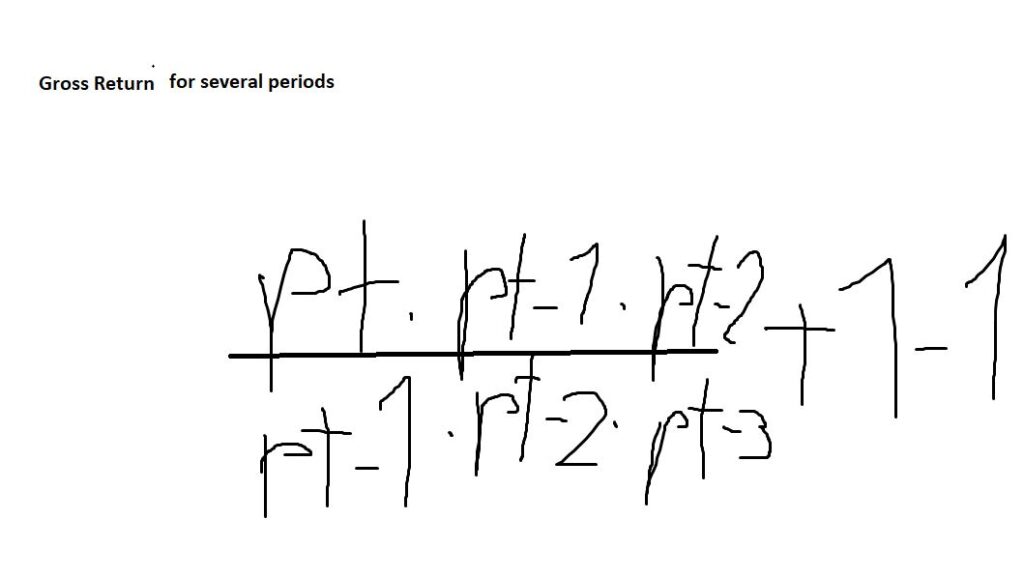

Gross return for several periods (discrete)

However, this doesn’t seem right in some cases: For example, in the case of stock returns. A series of stock returns is not a series of independent events (they depend on the previous returns). E.g., stock returns move all the time. Therefore one shouldn’t just calculate the discrete average return.

If you have discrete returns and you want to look for the average increase for some periods then you should calculate the geometric mean. Therefore you need to use the gross returns 1+ (pt-pt-1)/pt-1

Alternatively, you could calculate the log return (for stock returns)

This method takes into account compound interest. That means you get the return (e.g., interest) rates continuously/steadily (imagine the periods get infinitely small).

Contrary to discrete (arithmetic) returns, log returns are additive. Therefore you can sum them together.