Dickey-Fuller Test

The null hypothesis of the dickey fuller test is that your data is a random walk.

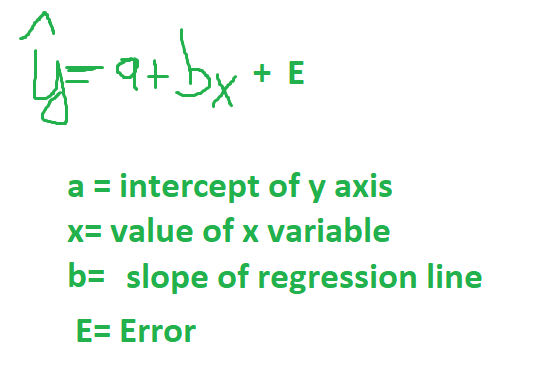

Sample Regression :

Now we could use our stock returns as an example

Y = return today

a = lets asume its 0

x= return yesterday

b = slope of returns regression line

E = White noise

Now we test if b (slope of lag returns) is 0. If yes then we can assume a random walk.

In practice:

Usually, if you perform an augmented dickey fuller test you get a p-value. Let’s assume you have an Alpha value of 5% . So you look at the p-value of the test. Is it less than 5%?

If yes you can reject the null hypothesis and assume the data is no random walk with a 95% confidence.

Portfolioflows

0