Autocorrelation

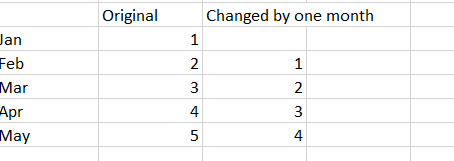

Autocorrelation measures the correlation of a time series with itself. Therefore, when analyzing autocorrelation, the correlated variables are the same, measured on different dates. (eg. – 1 month = 1 lag)

An autocorrelation different from 0 implies that a dataset can be forecast out of its past.

For example, let’s assume an EM Index is autocorrelated. Also, you have the returns for the last two months. Theoretically, you could now forecast the return for the next month based on the previous month’s buy using the Autocorrelation Function.

Portfolioflows

0